Market Commentary - 4.2.13

Turning the Calendar Six Years Ahead

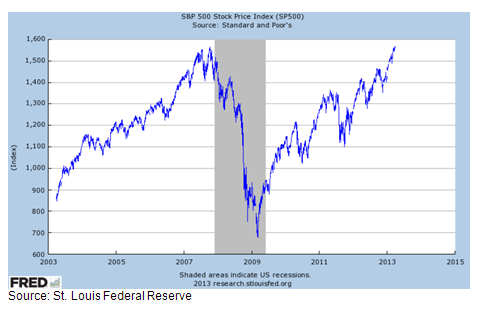

In retrospect, 2007 was a very interesting year. We saw the introduction of the first iPhone, the demise of the domestic housing market, and U.S. equities established all-time highs. Turning the calendar ahead to today, the iPhone continues to drive our imaginations and the housing market has made a remarkable bounceback. More importantly, just last week, as shown in the chart below, U.S. equities, as measured by the S&P 500, finally exceeded their 2007 peak. Stock market strength has been primarily driven by corporate earnings reaching new highs.

While stock markets rarely move in a straight line, the rally from March 2009 lows has been quite impressive. This year, U.S. equities are already ahead by double digits though investors have to be questioning whether or not the rally can continue. While we are not bearish on the equity markets, we do believe stocks could be due for a short breather, or at the minimum an increase in volatility. Some of the possible near-term issues that may weigh on stocks include the following:

With equity markets likely to face these headwinds and gyrate accordingly, we remain steadfast in our recommendations. While we continue to suggest equity allocations in-line with investment objectives, within equities we are biased toward domestic equities and larger capitalization companies. Throughout the portfolios, we continue to stress income via dividends or spread product (non-U.S. Treasury fixed income) and increased diversification.

This information compiled by Cetera Financial Group is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. The information has been selected to objectively convey the key drivers and catalysts standing behind current market direction and sentiment. No independent analysis has been performed and the material should not be construed as investment advice. Investment decisions should not be based on this material since the information contained here is a singular news update, and prudent investment decisions require the analysis of a much broader collection of facts and context. All economic and performance information is historical and not indicative of future results. Investors cannot invest directly in indices. This is not an offer, recommendation or solicitation of an offer to buy or sell any security and investment in any security covered in this material may not be advisable or suitable. Please consult your financial professional for more information.

While diversification may help reduce volatility and risk, it does not guarantee future performance. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability, and differences in accounting standards.

Multi-Financial Securities Corporation, its affiliates and subsidiaries and/or their officers and employees may from time to time acquire, hold or sell a position in the securities mentioned herein.