Are You Prepared for the High Cost of Dying?

End-of-life care and the death of a loved one not only carry an emotional price tag, but they might impose a substantial financial strain on families, compounding the emotional challenges that come with losing a loved one. Considering the true costs and unexpected fees can help illustrate why it is important to plan ahead for yourself and your loved ones.

Cost of end-of-life care

In the United States, the cost of inpatient hospital care during the last month of life can vary widely. In 2021, Americans spent about $430 billion on end-of-life and hospice care.1 The average hospital cost in the final month of life often exceeds $32,000, while the cost for hospice care is often more than $17,000 per month.2 These costs can spike if aggressive treatments, ventilators, or repeated interventions are involved.

Families often face costs that aren’t covered by Medicare, Medicaid, or private insurance, such as:

- Transportation to and from medical appointments

- Out-of-pocket prescription copays

- Medical equipment (special beds, oxygen)

- Home modifications for accessibility

- Unreimbursed caregiving labor by family members

Funeral and burial (or cremation) costs

In addition to costs associated with end-of-life care, expenses associated with traditional funerals and cremations may often exceed expectations. Expenses typically include:

- Basic service fees

- Embalming and body preparation (and/or cremation)

- Viewing and ceremony

- Transport and hearse

- Flowers, obituary announcements, and catering for a post-funeral gathering

- Cemetery plot, vault, and headstone (which can cost several thousand dollars)

After-Death Expenses

Legal and administrative costs

Expenses related to the administration of the estate can create further financial pressures. These include probate fees, which are court and attorney fees for settling an estate, often calculated based on a percentage of the estate’s total value. The exact cost depends on the size of the estate, its complexity, the jurisdiction, etc. Death certificates can also increase expenses as families often require multiple copies, typically for an extra fee per copy. The jurisdiction and any additional processing or delivery fees ultimately determine the total cost of death certificates. Other legal fees might include drafting or revising wills and trusts, which are essential for estate planning and can incur costs before and after a loved one passes.

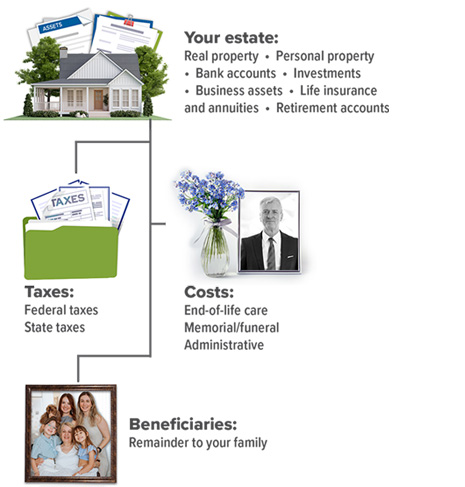

Estate taxes

A portion of your estate may be decreased by the imposition of federal and/or state estate or death taxes. Any U.S. citizen who leaves an estate (plus adjusted taxable gifts) in excess of the estate and gift tax basic exclusion amount ($13,990,000 in 2025) may be subject to estate tax. The highest federal estate tax rate is 40%. In addition to federal estate tax, several states also impose their own “death taxes” in the form of an estate tax or an inheritance tax, or both. There are 12 states and the District of Columbia that levy estate taxes, while six states have inheritance taxes. Maryland is the only state that imposes both an estate tax and an inheritance tax.

The importance of planning

Costs associated with end-of-life care, funeral arrangements, and administrative details represent major, and often overlooked, expenses. By seeking greater transparency and accessibility with regard to both medical and memorial arrangements, you can help ensure that financial hardship does not compound the pain of saying goodbye.