Strategies for Smarter Giving

With Americans contributing about $592 billion to charitable organizations in 2024, it is clear that charitable giving remains a powerful way to support the causes that matter most.1

In addition to advancing philanthropic goals, charitable donations may offer tax advantages. Here is an overview of some strategies to consider.

Donating appreciated assets

If you own appreciated assets, such as stocks, mutual funds, or real estate that have increased in value and have been held for more than 12 months, donating these directly to a qualified charity may be a tax-efficient way to give.

By donating assets directly, you may avoid paying capital gains tax on the appreciation, while still taking a deduction for the assets’ full fair market value, subject to IRS rules and limits.

Donor-advised fund (DAF)

A DAF is a charitable account offered by sponsors, such as financial institutions, community foundations, universities, and fraternal or religious organizations. Donors who itemize deductions on their federal income tax returns can write off DAF contributions in the year they are made, then gift funds later to the charities they want to support.

DAF contributions are irrevocable, which means the donor gives the sponsor legal control while retaining advisory privileges with respect to the distribution of funds and the investment of assets.

Because DAF assets can be invested for tax-free growth, this approach helps offer flexibility to spread out your giving and potentially increase your gifts while locking in a deduction in a high-income year, such as after receiving a large bonus, exercising stock options, or selling a business.

For taxpayers whose annual donations are close to the standard deduction amount ($15,750 for individuals or $31,500 for joint filers in 2025), combining several years’ worth of gifts into a single tax year can help you exceed the standard deduction threshold, maximize itemized deductions for that year, and then claim the standard deduction in alternate years.

DAFs have fees and expenses that donors giving directly to a charity would not face. All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful.

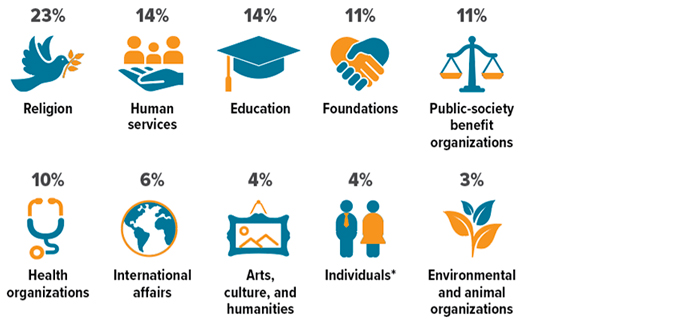

Recipients of charitable giving in 2024, by percentage of total contributions

*Primarily donations of medications from pharmaceutical company foundations

Source: Giving USA Foundation, 2025

Qualified charitable distribution (QCD)

For taxpayers age 70½ or older, QCDs offer another efficient way to give. With a QCD, you can transfer up to $108,000 annually in 2025 (indexed for inflation) directly from your traditional IRA to an eligible charity. The amount you transfer is excluded from taxable income, which may lower your adjusted gross income (AGI). This may help reduce Medicare premiums, limit the taxable portion of Social Security benefits, and preserve other tax breaks. The amount counts toward your required minimum distribution, which account owners must withdraw annually from their accounts, starting at age 73 or 75, depending on birth year.

QCDs can be useful for retirees who do not itemize deductions but still want the tax benefits of charitable giving. But QCDs cannot be made to DAFs, private foundations, or most supporting organizations.

Note: Starting in 2026, a floor of 0.5% of AGI will apply to itemized charitable deductions. Before taking any specific action, be sure to consult with your tax professional.