Surprise! It’s Retirement Time

“The best-laid plans of mice and men often go awry.” This famous saying, adapted from 18th-century Scottish poet Robert Burns, could apply to many aspects of life, including retirement. In 2025, four out of 10 retirees said they retired earlier than they had planned.1

Many early retirees reported reasons that were beyond their control, such as changes at their company or a health problem. However, 44% said they retired early because they could afford to do so.2

If you’re nearing the end of your working years, you probably have a retirement timetable in mind. But circumstances could change, and retirement might come sooner than you think. Considering these key issues now might help ease your transition and give you more options in how you retire.

Calculate your income stream

Would you be able to maintain your desired standard of living if you had to retire early? It might be helpful to define a budget and then calculate your projected income based on two different retirement dates: the date you prefer and an earlier date.

Keep in mind that your Social Security benefits would be reduced if you claim them before reaching your full retirement age (67 for those born in 1960 or later). And the sooner you retire, the less time your investments have to pursue potential growth — so accelerating your savings now could make a big difference.

Reduce your debt

Lowering or eliminating outstanding credit card balances and paying off auto loans could be great steps toward getting on track for retirement. Owning your home free and clear would be a big help in stretching your retirement income, but if this is not possible, you’re not alone: about one-third of homeowners age 65 and older are still paying off a mortgage.3 If you foresee your mortgage being an issue in your retirement years, you may want to explore options to pay it off early, reduce payments, modify the terms, or move to a less expensive residence.

Maintain disability coverage

Your employer may offer group coverage at reduced rates; however, you lose those benefits if your employment is terminated. Private disability income insurance can help you secure coverage specific to your needs, and since the premiums are typically paid with after-tax dollars, any benefits would generally be tax-free (unlike work-sponsored coverage that is paid with pre-tax dollars).

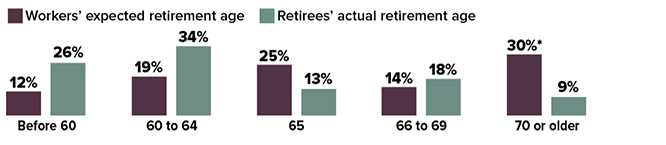

Expectations vs. Reality

The ages when current workers expect to retire are very different from the ages reported by current retirees. Although it’s possible that current workers might work longer than their predecessors, it’s wise to be prepared to retire earlier than planned.

*Includes workers who said they would never retire

Source: Employee Benefit Research Institute, 2025

Consider your health insurance options

Terminating employment prior to age 65 could leave you without health insurance. You may opt to continue your employer-sponsored health coverage for a limited period through the Consolidated Omnibus Reconciliation Act (COBRA), but this can be quite expensive. If you’re married and your spouse works, you might get coverage under your spouse’s plan. You could also seek coverage through the federal or state-based health insurance marketplace.

Know the tax rules

You can generally withdraw assets from your workplace retirement plan and/or IRA after age 59½ without penalty. Although ordinary income taxes apply to distributions from pre-tax accounts, qualified withdrawals from Roth accounts are tax-free under current tax law.4 If you need funds prior to age 59½, be aware of IRS exceptions to the 10% early withdrawal penalty. These include disability, terminal illness, leaving an employer after age 55 (work-based plans only),5 paying for unreimbursed medical expenses that exceed 7.5% of your adjusted gross income, and paying for health insurance premiums after a job loss (IRAs only).

Surprises can be fun in many situations, but not when it comes to retirement. Preparing now could help ease you into a more comfortable retirement lifestyle.