What Happens to Your Time Horizon at Retirement?

In investing, “time horizon” refers to the amount of time you have to pursue a financial goal. Along with that goal and your tolerance for risk, your time horizon is one of three key factors that typically help determine the mix of investments in your portfolio.

In your early retirement saving years, your time horizon could be a strong advantage. The younger you are, the more time you may have to withstand market volatility and pursue an aggressive growth investment strategy.

As you enter retirement, however, your time horizon begins to take on new meaning. Your investment strategy is no longer crafted to pursue a specific savings goal but to balance different objectives. Understanding these objectives can help you shift your perspective from a single, goal-based, fixed time horizon to a multilayered, interrelated series of time periods.

Short-term objective: liquidity

The first objective is generally the need for liquidity; that is, how much cash you may need to keep in easily accessible, lower-risk vehicles.

You can start this assessment by determining the amount of income you’ll need to meet life’s basic necessities on a monthly or annual basis. After accounting for Social Security, Medicare and other health insurance, any pension income or work-related earnings, and possible income from real estate and other sources, is there a gap? If so, how much and how often will you need to withdraw from your retirement savings to cover that gap?

Next, consider the bigger picture: What are your plans over the next one to three years? Will you have any large expenses, such as buying a new car, repairing a roof, or undergoing a major health procedure? Will you take any vacations or attend big events such as a wedding? Finally, how much do you want to set aside for unexpected emergencies? General guidance suggests having at least three to six months of expenses in an easy-to-access savings vehicle, but the appropriate amount will depend on your unique situation. Considering all of these factors can help you determine how much to invest in short-term, lower-risk vehicles and set up a cash-flow schedule designed to meet your shorter-term needs.

Ongoing objective: managing market risk

The second objective is typically managing the risk associated with ongoing market volatility. Pre-retirees and retirees, in particular, face what’s known as “sequence of returns” risk. This refers to the risk that the financial markets could experience a large loss just before or in the early years of retirement, leaving you with a diminished nest egg to support your income needs. Moreover, throughout your retirement, your portfolio will likely continue to experience ups and downs. The objective is to manage investments in a way that strives to provide income while helping to smooth out any bumps over time.

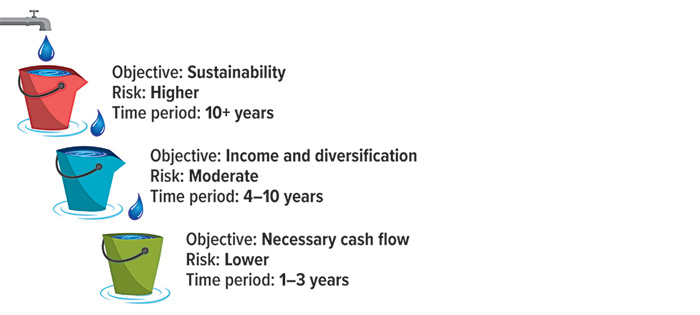

Retirement Portfolio: A Multilayered Approach

As each layer is depleted, it may be replenished by the next layer up.

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful. Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss. Rates of return will vary over time, particularly for long-term investments. Investments offering the potential for higher rates of return involve higher risk.

Long-term objective: sustainability

While market risk is one concern, longevity risk, or the chance that your savings won’t last as long as you do, is yet another. The need to build a portfolio with lasting potential — at a minimum, to sustain your lifelong income needs, but also to leave a legacy if that is your goal — is perhaps the most important objective in a retirement portfolio. Consider designing an investment mix to pursue enough growth to help keep it sustainable as long as needed.

A layered approach

One way to think about your retirement portfolio is as a series of layers that could work together to pursue all three objectives. The bottom layer would be comprised of short-term, liquid vehicles designed to provide the cash flow needed for, say, one to three years. The middle layer would contain additional amounts needed within a decade or so and be made up of moderate-risk vehicles that aim to provide a stream of income and help balance inevitable volatility. The top layer, which would include the balance of your portfolio, would be designed to outpace inflation and pursue longer-term growth, striving for that necessary sustainability. Over time, as one layer is depleted, it can be replenished by the next layer up.