Market Commentary - 2.1.12

Looking Past Europe

As January comes to a close, U.S. equities have provided investors with solid, mid-single digit returns. Despite the positive year-to-date performance in the Dow Jones Industrial Average, S&P 500 and NASDAQ Composite, investors remain somewhat skittish and continue to focus on news across the Atlantic. Following the proverbial "two steps forward, one step back," every day we hear about the trials and tribulations of European nations struggling with excess debt, fiscal irresponsibility and economic aid packages. In fact, since the Greek debt crisis provoked a Europe-wide drama two years ago, European leaders have engaged in 16 summits to solve this never-ending story.

Two years! How can this be the case? Haven't European bankers had enough practice? Wasn't modern banking started in Europe? Interestingly enough, today's form of banking was first invented in the Middle Ages by Italian merchants to finance grain production. Common terms used in today's banking can trace their roots back to these times. Because most trading and banking took place in open markets on benches, the word bank is derived from the Italian word for bench, "banca." Bankrupt is a combination of two Italian words, "banca" and "rotta," which taken literally mean "broken bench."

With investors focusing so much time on the mixed news from Europe and basing their investment decisions accordingly, we need to remind ourselves that there are other market factors to also pay attention to. For instance, three key fundamentals to stock market performance - corporate earnings, the economy, and low interest rates – are key indicators that we should all focus on.

As of the end of January, of the 192 companies within the S&P 500 that have posted fourth quarter earnings, 128 (67%) have reported better-than-expected earnings. Collectively, this quarter S&P 500 company earnings have risen by 2.6%, while revenues have risen by 6%. This is a positive for the stock market because historically, stock prices tend to move with earnings.

On the economic front, despite a couple of recent hiccups, during the month of January, we have seen modest improvement in manufacturing, housing, consumer, inflation and employment data. Late last year, market prognosticators were expecting a double-dip recession. However, recent economic data, such as the sharp drop in initial jobless claims (see chart below), suggests a low probability for this scenario. A healthy economy is necessary for the stock market to continue to post gains.

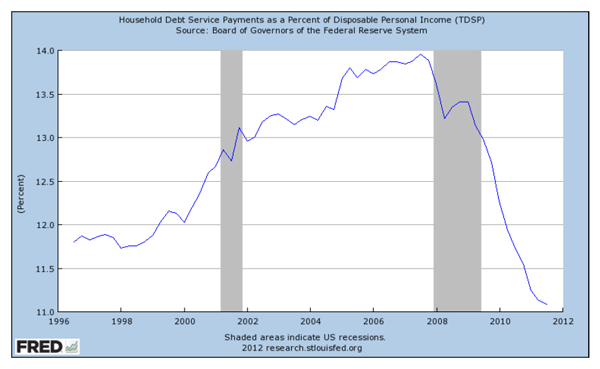

In late January, the Federal Reserve announced that it will probably keep interest rates low until 2014. This is great news because low interest rates can stimulate economic growth, as the cost of borrowing is attractive, and allow corporations and consumers to repair their balance sheets. By replacing higher interest rate bonds with lower interest rate bonds and refinancing mortgages and credit cards, the debt burden of both companies and consumers has dropped (chart below shows debt burden as a percent of personal income). A lower debt burden promotes economic growth.

Overall, January proved to be a positive month for the equity markets. While events in Europe are important, we do not believe they will have long-running negative consequences for investors. More importantly, other factors important to stock market performance, corporate earnings, improving economic indicators and low interest rates, continue to paint a better picture. With that said, we are not waving the all clear signal. Instead, we suggest investors be prudent in their portfolios and take advantage of opportunities as they arise. In particular, we continue to believe income producing vehicles, such as dividend-paying equities and corporate bonds, are attractive and their income component offers the advantage of mitigating portfolio volatility.

This information is compiled by Cetera Financial Group from source material obtained or provided by US federal and state departmental websites, equity index sponsors Standard & Poor's, Dow Jones, and NASDAQ, credit ratings agencies Standard & Poor's, Moody's Ratings, & Fitch Ratings, domestic and foreign corporate issued newswires and press statements, and from referenced compilations and index readings by Bloomberg Professional. The information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. The information has been selected to objectively convey the key drivers and catalysts standing behind current market direction and sentiment. No independent analysis has been performed and the material should not be construed as investment advice. Investment decisions should not be based on this material since the information contained here is a singular news update, and prudent investment decisions require the analysis of a much broader collection of facts and context. All economic and performance information is historical and not indicative of future results. Investors cannot invest directly in indices. This is not an offer, recommendation or solicitation of an offer to buy or sell any security and investment in any security covered in this material may not be advisable or suitable. Please consult your financial professional for more information.

While diversification may help reduce volatility and risk, it does not guarantee future performance. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability, and differences in accounting standards.

Multi-Financial Securities Corporation, its affiliates and subsidiaries and/or their officers and employees may from time to time acquire, hold or sell a position in the securities mentioned herein.